Its Compute & Networking segment provides Data Center platforms and systems for AI, HPC, and accelerated computing Mellanox networking and interconnect solutions automotive AI Cockpit, autonomous driving development agreements, and autonomous vehicle solutions cryptocurrency mining processors Jetson for robotics and other embedded platforms and NVIDIA AI Enterprise and other software. NVDA 122.28 -2.88 (-2.30) Will NVDA be a Portfolio Killer in September. The company’s Graphics segment offers GeForce GPUs for gaming and PCs, the GeForce NOW game streaming service and related infrastructure, and solutions for gaming platforms Quadro/NVIDIA RTX GPUs for enterprise workstation graphics vGPU software for cloud-based visual and virtual computing automotive platforms for infotainment systems and Omniverse software for building 3D designs and virtual worlds. Revenue is calculated by multiplying the price at which goods or services are sold by the number of units or amount sold. The current year Consolidated Income is expected to grow to about 5.4 B.

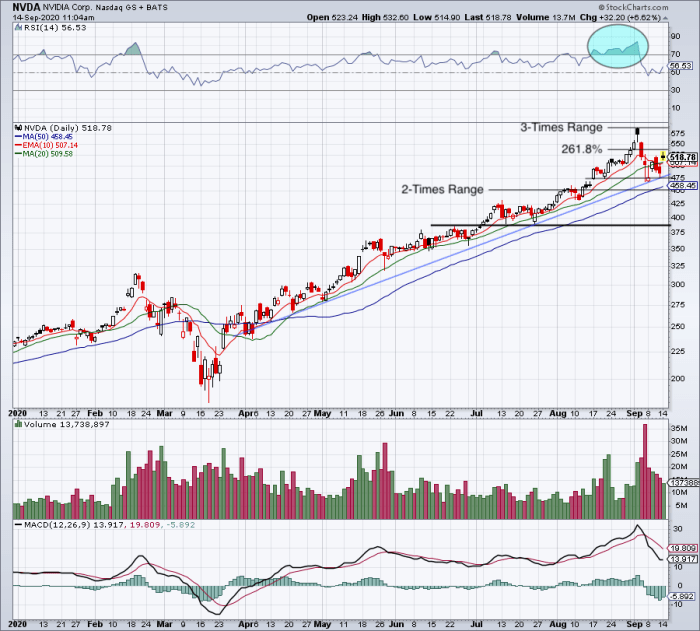

From 2010 to 2022 Nvidia Corp Cost of Revenue quarterly data regression line had arithmetic mean of 4,035,059,008 and slope of 478,328,311. 3) Trend line formed by connecting highs of Feb 16, July 6, and Aug 30 NASDAQ:NVDA. Ongoing Cost of Revenue is projected to grow to about 7.8 B this year. NVIDIA Corporation provides graphics, and compute and networking solutions in the United States, Taiwan, China, and internationally. NVIDIA (NASDAQ:NVDA) has a market capitalization of 300.69 billion and generates 26.91 billion in revenue each year. Nvidia has taken support from 1) 61.8 Fibonacci retracement level from the lows of gap up point of October 25 to high of Nov 22 2) 38.2 Fibonacci retracement level from the breakout level to the highs of Nov 22.

0 kommentar(er)

0 kommentar(er)